How Ach Processing can Save You Time, Stress, and Money.

For many years, the world of banking has changed drastically as well as has globally impacted countless individuals. During this age of growth, instead of paying by cash money, checks, credit scores or debit card, the repayment procedure has evolved right into much faster, much safer and also much more efficient electronic techniques of transferring money. Automated Clearing House (ACH) has made this feasible.

Considering that the early 1970s, this united state monetary network permits organizations to move cash without utilizing paper checks, bank card networks, wire transfers or cash money - domestically and around the world. Greater than 25 billion ACH purchases are processed annually by the Automated Clearing Residence Network consisting of a digital network of banks as well as banks supporting both ACH credit and debit repayments in the U.S

There are 2 major groups for which both consumers as well as organizations use an ACH transfer. Straight settlements (ACH debit transactions) Direct deposits (ACH credit rating transactions) Some monetary establishments additionally provide expense repayment, which permits individuals to set up and also pay all costs electronically making use of ACH transfers. Or you can use the network to start ACH deals between individuals or vendors abroad.

Usually, ACH transfers clear the financial institution in simply a couple of organization days unless there are not enough funds in the account. Deals can take longer under particular circumstancessuch as if the system discovers a potentially fraudulent purchase. An ACH settlement is made through the ACH network, instead than going through the major card networks like Visa or Mastercard. ach processing.

About Ach Processing

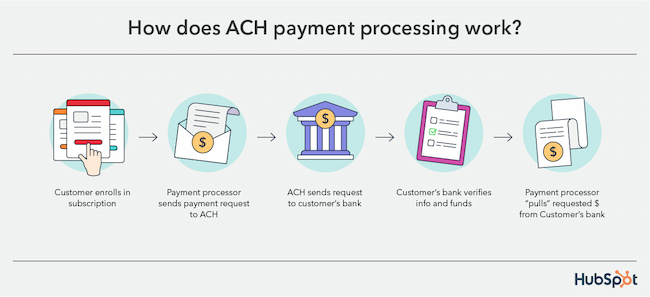

An ACH debit transaction does not involve physical paper checks or debit card. To start a transaction with ACH, you'll need to license your biller, such as your electric firm, to pull funds from your account.

You may enable an energy business to instantly bill your account for regular monthly expenses. The biller launches the transaction, as well as you do not need to take any activity. You can also set up a link in between your biller and also your financial institution account without licensing automated payments. This provides you greater control of your account, permitting you to send repayment funds only when you specifically permit it.

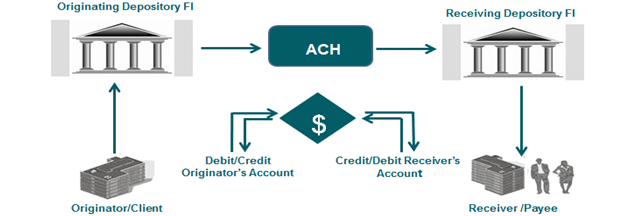

It moves money from the company's financial institution account to a worker's in a very easy and also reasonably inexpensive way. The company simply asks their monetary establishment (or pay-roll business) to instruct the ACH network to draw money from their account and deposit it as necessary. Similarly, ACH deposits permit people to initiate down payments elsewherebe that a bill settlement or a peer-to-peer transfer to a buddy or landlord.

Some Known Incorrect Statements About Ach Processing

An ACH direct repayment delivers funds right into a pop over here financial institution account as credit report. When you obtain settlements via straight down payment with ACH, the advantages consist of comfort, less charges, no paper checks, as well as quicker tax obligation refunds.

Photo resource: The Equilibrium The number of debit or ACH debts processed each year is progressively raising. In 2020, the ACH network processed financial transactions worth greater than $61. 9 trillion, an increase of nearly 11 percent from the previous year. These included federal government, customer, and also business-to-business purchases, in addition to worldwide repayments.

The 5. 3 billion B2B paymentsvalued at $50 trillionreflect a 20. 4% boost from 2020, as the pandemic fast-tracked services' switch to ACH settlements. Over just the previous two years, ACH B2B repayments are up 33. 2%. An ACH credit scores entails ACH transfers where funds are pressed right into a bank account.

As an example, when a person establishes up a settlements through their bank or lending institution look what i found to pay bills from their nominated checking account, these payments would certainly be refined as ACH debts. ACH debit purchases include ACH transfers where funds are drawn from a financial institution account. That is, the payer, or consumer offers the payee approval to full payments from their nominated checking account whenever it becomes due.

The Best Strategy To Use For Ach Processing

ACH and bank card settlements both enable you to take repeating payments merely as well as conveniently. There are three major distinctions that it may be beneficial to highlight: the assurance of settlement, automated clearing residence processing times, as well as costs. When it concerns ACH vs. bank card, the most important distinction is the guarantee of repayment.

Comments on “The Basic Principles Of Ach Processing”